Leverage the power of contactless disbursements

What is Currencie™?

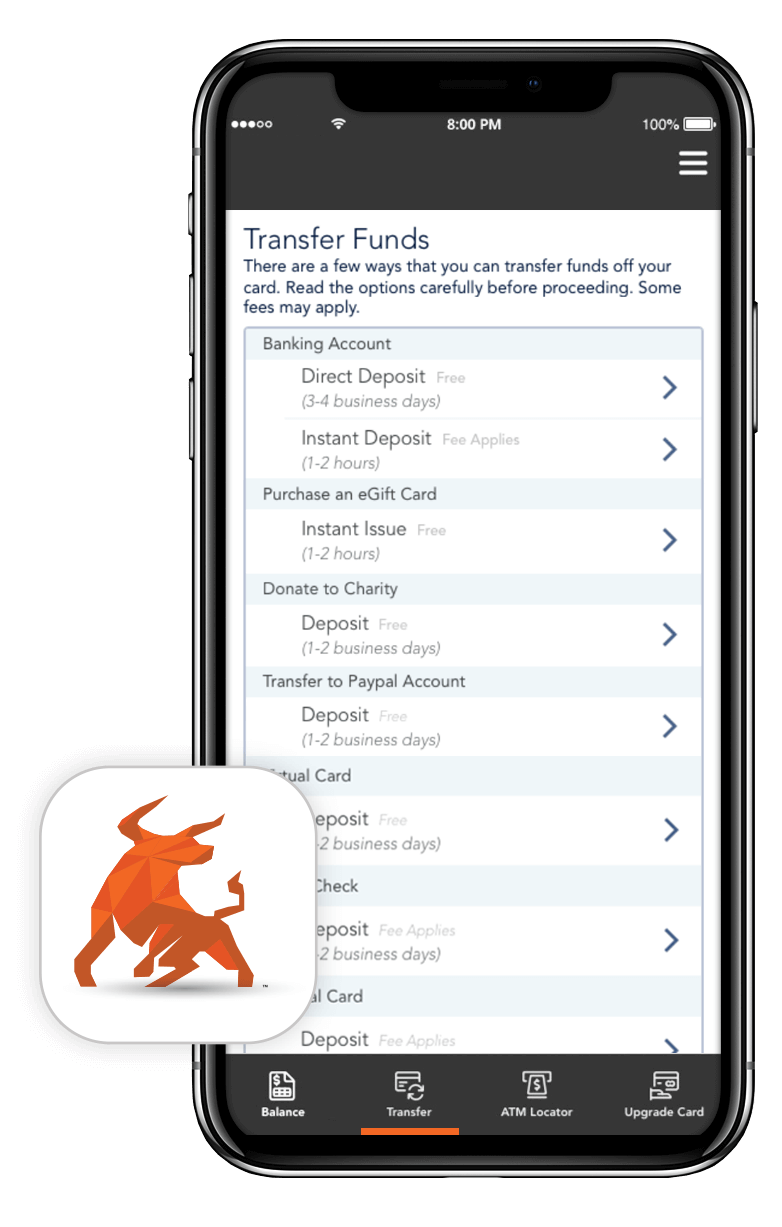

Currencie is a Disbursement as a Service (DaaS) platform, allowing your organization to make payments, both individually and en mass, via an electronic payment platform. Recipients of funds can access money online through a variety of claim options, including bank transfers, PayPal, check, charity, gift card, or pre-paid card.

With Currencie you can:

The hassle-free way to pay clients and beneficiaries accurately and on time

PAY ELECTRONICALLY

WITH EASE

- Simply upload your check file and fund your payments — Currencie does the rest!

VIRTUAL

PRE-PAID CARDS

- Auto-load funds to virtual pre-paid cards prior to disbursing payables

- Electronic funds automatically pulled or pushed from your bank account — whichever you choose

- When electronic payables are unavailable, physical checks are mailed on your behalf

- Vendors will love you for eliminating the hassle of writing checks

PROFITABLE REBATE PAYMENTS

- Earn cash back on all eligible accounts payable transactions

Paper checks versus electronic payments: the differences are clear

88%

organizations who have converted to electronic payments as a way to increase efficiency

Source: 2018 AFP Payments Cost Benchmarking Survey

74%

organizations that have experienced check fraud

Source: 2020 AFP Payments Fraud and Control Survey Report

$7.78

the average cost to issue a paper check — implementing electronic payments can save up to 93% in costs annually

Source: Aberdeen Group

Cost Comparison

500 checks per month

| Paper Checks $7.78 per check |

Electronic Payments Nominal fee |

|

| Daily | $130.00 | $8.16 |

| Monthly | $3,890.00 | $245.00 |

| Annual | $46,680.00 | $2,940.00 |

| Savings | 176.3% |

CARDS OR OTHER FINANCIAL PRODUCTS ARE ISSUED BY CACHE VALLEY BANK PURSUANT TO LICENSES BY MASTERCARD INTERNATIONAL INCORPORATED. MASTERCARD IS A REGISTERED TRADEMARK OF MASTERCARD INTERNATIONAL INCORPORATED. CACHE VALLEY BANK IS A MEMBER OF THE FEDERAL DEPOSIT INSURANCE CORPORATION (“FDIC”) AND ALL ACCOUNT AND CARDHOLDERS’ FUNDS THAT ARE PLACED BY TYLER OR RAPID INTO THE CACHE VALLEY BANK AS YOUR AGENT AND CUSTODIAN ARE ELIGIBLE FOR FDIC PASS-THROUGH INSURANCE IN ACCORDANCE WITH THE FDIC’S APPLICABLE TERMS AND CONDITIONS.

EVOLVE BANK & TRUST AND/OR GREEN DOT BANK OR GO2BANK, WHICH IS GREEN DOT’S FLAGSHIP MOBILE BANK, ALSO OFFER SREVICES AVAILABLE TO YOU IF YOU WANT TO TRANSFER YOUR FUNDS OR CREATE A MOBILE BANK ACCOUNT TO USE YOUR FUNDS. THESE SERVICES CAN BE ACCESSED THROUGH THE LINKS ON OUR WEB PAGES